venmo tax reporting reddit

By Tim Fitzsimons. Starting January 1st 2022 VenmoPayPal and other similar apps must report annual commercial transactions of 600 or more to the IRS.

Well It Has Happened Apparently Has Anyone Else Had This Appear When Trying To Buy Sell With Paypal I Didn T Know The Snoop On Everyone S Bank Accounts Bill Had Passed Already If This Isn T

Congress updated the rules in the American Rescue Plan Act of 2021.

. Rather small business owners independent contractors and those with a. The IRS is hiring a bunch of people specifically to cover this change so I expect a high percentage of audits on people that have new 1099 income from these sources that operate below the previous. Use the Right Tax Form.

Financial institutions must report Venmo transactions to the IRS. This new regulation a provision of the 2021 American Rescue Plan now requires earnings over 600 paid. If you meet the reporting threshold for a 1099K yes.

Venmo tax reporting 2022 reddit Saturday May 14 2022 Edit Minimum purchase - 200 000 coins. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions.

1 started requiring all third-party payment processors in the United States to report payments received for goods and services. Get the scoop on Venmo and your taxes in 2022. As an example -.

The 19 trillion stimulus package was signed into law in March. The new rule is a result of the American Rescue Plan. Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and services.

For any tax advice you would need to speak with a tax expert. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. It is your responsibility to determine what if any taxes apply to the payments you make or receive and it is your responsibility to collect report and remit the correct tax to the appropriate tax authority.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. Individuals who have sold cryptocurrency on Venmo during the 2021 tax year will receive a Gains and Losses Statement irrespective of their state of residence. Thats because theres a new tax reporting law that could impact your tax return next year.

Those employing freelancers and other independent contractors should be sure to make them complete a W-9 form just before they start working. And International Federal State or local. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

I run a small business selling computers and have a question regarding properly assessing sales tax. Will Venmo have new taxes in 2022. The new tax reporting requirement will impact 2022 tax returns filed in 2023.

A 1099-K will be issued by payment processors if you have more than 600 of aggregate payments during the year starting. First of all located and selling in California as a Sole Proprietor. News discussion policy and law relating to any tax - US.

Paypal will report it as income and the burden of proof is on the taxpayer to prove that it is not taxable which would be part of your tax return. Venmo tax reporting 2022 reddit Friday March 11 2022 Edit. First of all located and selling in California as a Sole Proprietor.

Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. Will Venmo provide me any documentation for tax reporting. Reddits home for tax geeks and taxpayers.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business. Dont post questions related to that here please. If a person accrues more than 600 annually in commercial payments then Venmo must file and furnish a Form 1099-K reporting on all commercial income.

1 the IRS said if a person accrues more than 600. To help ensure compliance with new federal regulations payments received for sales of goods and services in excess of federal or state reporting thresholds will be. Zelle rhymes with sell is a peer-to-peer or person-to-person app that enables you to send money quickly from your bank account to.

Sites like Venmo and PayPal now must report business transactions to the IRS when they total 600year. Businesses using Venmo to pay employees should be sure to issue them a 1099-MISC form especially if you pay them more than 600 a year. So heres the details.

This only applies to selling goods. Heres what I found on Venmos User Agreement page. I sell a PC for 100000 tax included.

Here are the details debunked. Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year. While Venmo is required to send this form.

But CNBC says No the IRS isnt taxing your Venmo transactions It says a new law that took effect January 1st applies to small businesses to. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS. This new rule wont affect 2021 federal tax.

The new rule which took effect. Company is not responsible for determining whether taxes apply to your transaction. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

The new rule which took effect. The IRS is experiencing significant and extended delays in processing - everything. You can find information from the IRS here and here.

That means more than 20000 of receipts or more than 200 transactions through their network. Answer 1 of 2.

Reddit Revamped Its Block Feature So Blocking Actually Works Wilson S Media

Homeschool Groups Prepare For New 1099 K Reports If You Use Paypal Stripe Venmo Etc Homeschoolcpa Com

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

Don T Waste Your Money Venmo And Zelle Taxes

Yay Not Venmo Paypal Now Mercari Nothing Is Safe Any More R Mercari

Ama Hi Reddit I M Steve Ehrlich Voyager S Co Founder And Ceo Ask Me Anything R Invest Voyager

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs R Monero

Paypal Venmo Cash App Will Start Reporting 600 Transactions To The Irs

Reddit Comments Are Finally Searchable Wilson S Media

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Truth Or Hoax Is The Irs About To Tax Your Venmo And Zelle Transfers Nbc4 Wcmh Tv

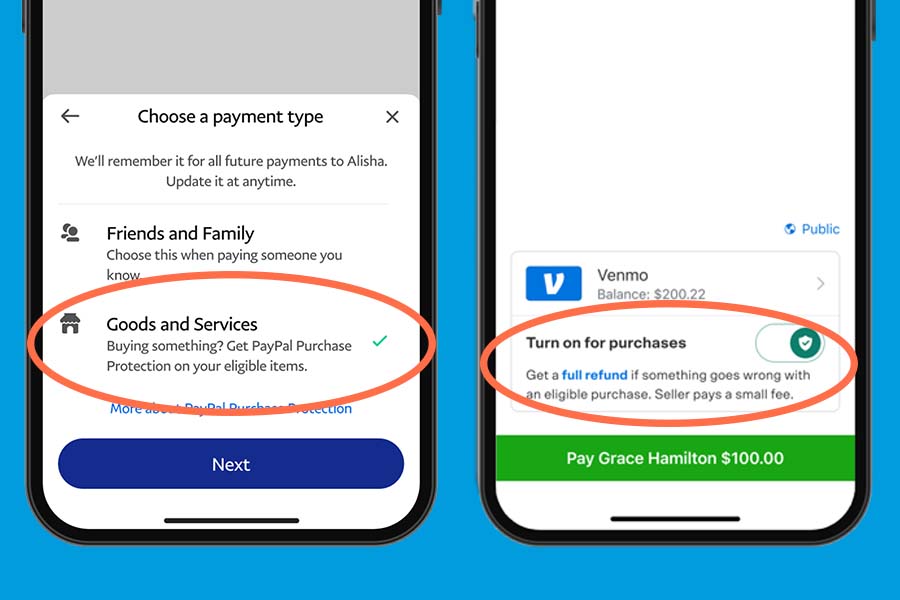

New U S Tax Reporting Requirements 2022 Paypal Watchintyme

Beware Of New Tax Rule Affecting People Who Use Venmo Paypal Or Other Payment Apps Tax Attorney Orange County Ca Kahn Tax Law

Threshold For Cash App Payments Drastically Lowered For Tax Payments Radio Facts

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

Pnc Customers Can T Access Venmo Third Party Payment Apps Whyy

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance